Our Partnership Pays Dividends

Dividends are a result of strong investment earnings from our customers’ premium dollars, efficient claims processing and safer workplaces. When that happens, our customers share in the financial strength of our company.

Frequently Asked Questions

As Montana’s not-for-profit option for workers’ compensation insurance, we share strong financial results with our customers through dividends. Through efficient claims management, improved safety efforts by employers and their workers, and responsible stewardship and investment of policyholder premium dollars, we take what would otherwise be considered profit and return it to our customers (unlike for-profit insurance companies).

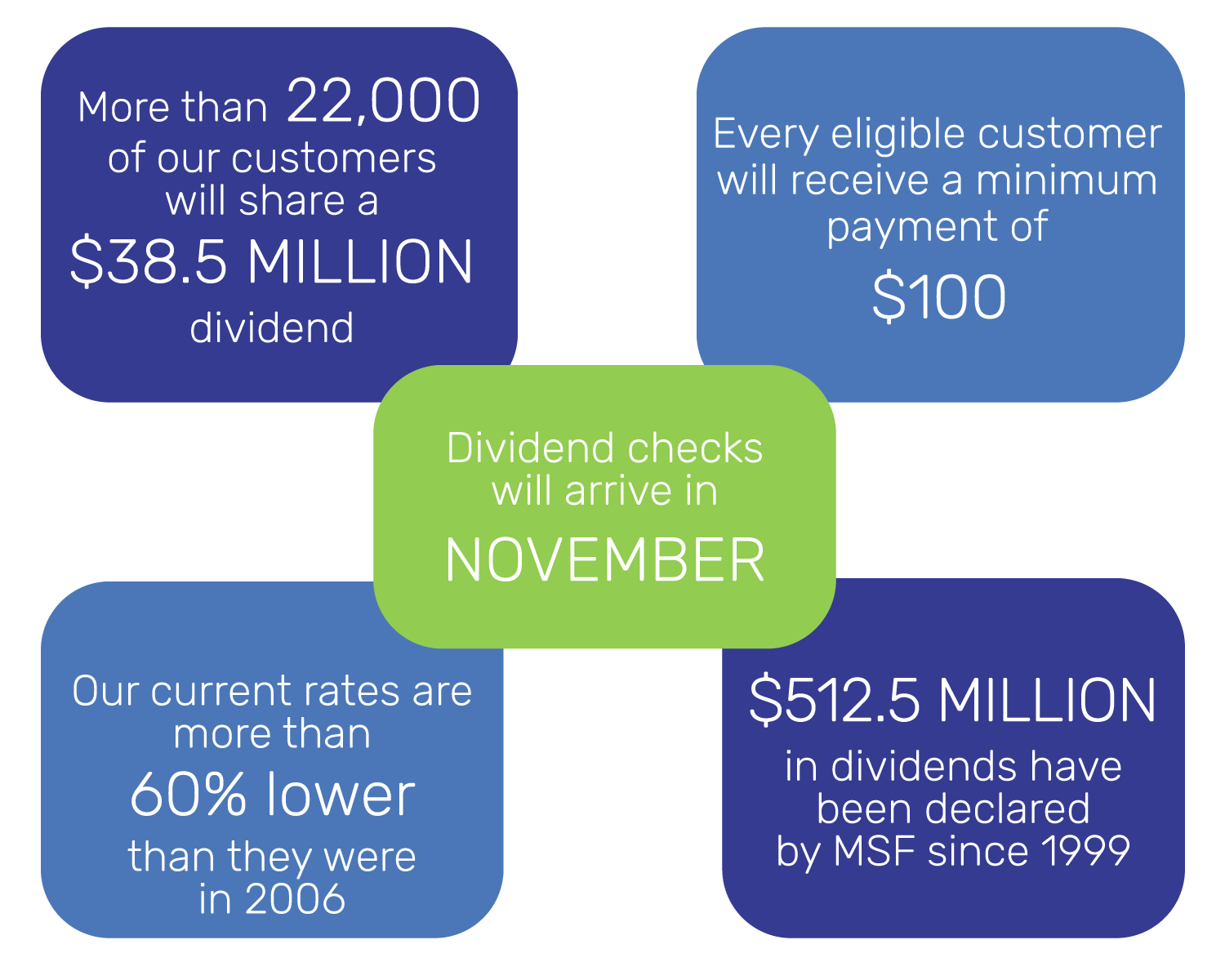

On September 12, 2025, our Board of Directors declared a $38.5 million dividend for more than 22,000 policyholders. MSF has returned $512.5 million to employers since 1999.

If you had a policy with us that expired between January 1, 2024 and December 31, 2024 and it was active for at least six months (using premium data as of 7/31/2025), you are eligible for a dividend. We call this timeframe dividend year 2024.

If you have an outstanding balance or account issue (like bad debt, referred to collections, promissory note, bankruptcy, cancelled with a balance or payroll report owed to MSF), we’ll first apply your dividend as a credit. If there’s anything left after that, we’ll send you a check.

You will not receive a dividend check if:

- Your policy was cancelled and did not meet the 6-month requirement.

- Payroll reports or audits within the dividend year were not resolved or completed by July 31, 2025.

Is there a minimum dividend check amount?

Yes, the minimum dividend amount is $100.

How do you calculate my dividend?

Dividend amounts are a flat percentage of the premium you paid. If your dividend calculates to less than $100, you’ll receive the $100 minimum. For this year, the flat rate percentage is 22.99%.

Do smaller accounts receive a lesser percentage of dividends than large accounts?

No. Everyone gets the same percentage of premium back. The only exception is when the amount is under $100, in which case, the minimum of $100 applies.

I participated in a group association safety plan. Does that affect my eligibility for a dividend?

You may still qualify. Your dividend percentage will be applied to your premium after any premium adjustments or group plan retrospective returns are calculated.

How many employers will receive a dividend?

More than 22,000 employers will receive a dividend from MSF this year.

Does every insurance company declare dividends to policyholders?

No, insurance companies are not required to pay dividends. Many pay dividends to their stockholders or stockholders and policyholders. MSF is different. We return dividends only to our policyholders.

Does Montana State Fund declare dividends each year?

Dividends aren’t guaranteed. Each year, MSF’s Board of Directors reviews our financial position with input from our independent actuary’s analysis of our policyholder equity and decides if it’s safe to declare a dividend. That said, we are proud to have been able to return dividends for 27 straight years.

Why don’t you just lower my premiums instead of giving me a dividend?

Dividends are separate from rates. Premiums cover expected claims and expenses. Most years, MSF operates at an underwriting loss or break-even, meaning that premium collected from rates either does not cover, or just covers anticipated expenses. Investment income covers any expense deficit.

Dividends happen when things go better-than-expected: fewer than expected losses (accidents), stronger investment returns, or both. Because we’re a not-for-profit insurer, when MSF achieves positive financial performance, our policyholders reap the benefits!

I am part of a Professional Employer Organization (PEO), but I did not receive a dividend. Why?

If you were in a PEO during the dividend year, your premium was combined with the group’s total premium. Any dividend awarded would have been issued directly to your PEO as one check. If you’re unsure, call our Customer Service team at 800-332-6102 and we’ll check your account.

Give us a call at 800-332-6102 and we will be happy to help.

We would love to have you back! You can request a quote directly from us (give us a call at 800-332-6102), or work with one of our many independent insurance agent partners across Montana. There is no extra cost to use an agent.

Access an alphabetical listing of all appointed agents by city.